K-Beauty’s Third Wave Is Here — & They Saved The Best For Last

Say goodbye to panda masks and banana hand cream. The newest imports from Korea are heavy on science, light on gimmicks.

Ask any American consumer about K-beauty, and they might tell you about the panda-face sheet mask they bought from Amazon or the kitten-shaped lip gloss they saw in line at CVS. But while cutesy prints and cartoon animals have become a hallmark of the category in the U.S., many Korean women argue that’s only the fringe of the market. In reality, K-Beauty is a skin-care tradition steeped in wellness, simplicity, and efficacy.

“Yes, there is a cute market in Korea, but that is a trend that comes and goes,” says Jacklyn Lim, the Chief Marketing Officer at CarverKorea, the Seoul-based beauty company that created the skin-care brand AHC. “The core essence of K-beauty is about utilizing the right products to take care of yourself and be your best self. In the U.S., it’s gotten this weird positioning where it’s the cartoony stuff, and you’ve got to do these seven steps.”

AdvertisementADVERTISEMENT

That perception is partly due to social media, where bubbly face masks and shelfies full of colorful fruit-shaped tubes are catnip for likes and shares. “It’s only one element of what Korean skin care is, but it is so Instagrammable,” says Liah Yoo, who formerly worked with K-beauty giant Amorepacific and launched her own clean beauty brand, Krave Beauty, in 2017. "Back then, if you walked into an American drugstore, there was nothing like a panda mask or banana hand cream."

Since then, the K-Beauty category has grown exponentially from $59 million in 2012 to a whopping $511 million in 2018. You can now find Korean-inspired sections in every retailer from CVS to Saks Fifth Avenue. But for those who think the K-Beauty phenomenon has crested, we've still only seen a fraction of the market. In fact, the latest imports are some of the country’s biggest power players — and have the potential to completely transform the perception of the category.

“The very first wave of [K-beauty] was focused on making interesting products packaged in a unique way,” explains Yoo. “It was very eye-catching and generated a lot of viral videos and user-generated content. Sheet masks and a multi-step skin-care routine was the second generation of K-beauty in the U.S. The third wave isn’t about the trends or viral product. It’s going to be more focused on building long-lasting, sustainable brands in the U.S.”

“

"The third wave isn’t about the trends or viral product. It’s going to be more focused on building long-lasting, sustainable brands in the U.S.”

Liah Yoo

”

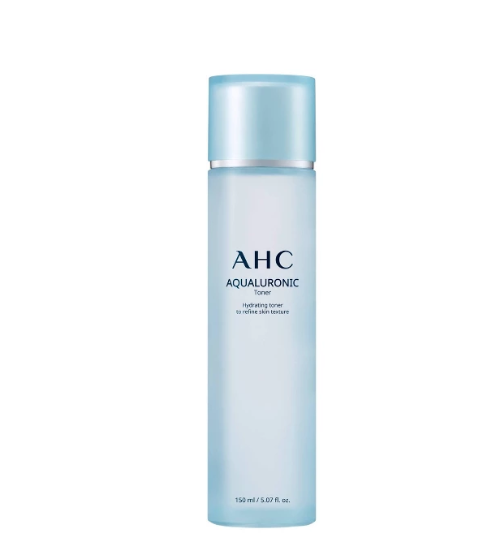

For these new recruits, the brand story isn’t about trendy ingredients or Instagram-worthy gimmicks — it’s about efficacy. AHC, a South Korean skin-care brand known for its spas, recently launched six products in its hyaluronic acid-packed lineup that’s tailored to the U.S. consumer. Mediheal, Korea’s #1 sheet mask brand, also dropped in the U.S. this summer; its products are denoted by an unassuming I.V. logo. And Amorepacific’s no-frills Primera line, which is focused on botanical and natural ingredients, is already a star player in Sephora’s Clean Beauty section.

AdvertisementADVERTISEMENT

While all three of these names were relatively unknown to American consumers before 2019, they're all well-established institutions in Seoul. AHC has more than 5,000 spas in South Korea and even featured Anne Hathaway in its skin-care campaigns in 2017. Mediheal sells five masks every second between the 30 Asian Pacific countries where it’s sold. And Primera has a flagship store in the heart of the Myeong-dong shopping district of Seoul, where customers line up daily for its best-selling Miracle Seed Essence.

So why have some of the biggest players in the K-beauty space delayed their entrance into the lucrative American market until now? With a strong tourist relationship between Korea and China, not all brands were focused on expansion, Yoo hypothesizes. “A lot of K-beauty brands were reliant on Chinese visiting Korea and stocking up with suitcases, but the trade agreements and political climate has made travel rough,” says Yoo.

Yoo is largely referring to the travel bans China enacted in 2017 after South Korea launched a U.S.-made anti-ballistic missile system that could potentially spy on Chinese military activity. The number of Chinese tourists visiting South Korea between March and October of that year plunged by more than 60% — and the effects were felt all across the Korean economy, including in the beauty industry. “The barrier to entry in the Chinese market has gotten higher. Naturally, a lot of the K-beauty brands are realizing they need to enter a new market and diversify to generate more revenue,” says Yoo.

AdvertisementADVERTISEMENT

Many of these Seoul-based companies have now turned their eyes to the Middle East, Russia, and the U.S. as potential business opportunities. They’ve also found big-name partners to help them transition into a new market. “AHC has always had global ambitions as a company,” says Lim. “For us to do this as an independent company, there would be limitations — resource and knowledge-wise — and getting into new markets would be limited.”

Chief among the company's challenges? Brand recognition. “The U.S. market is harder to penetrate because American consumers are more brand-driven than product-driven,” says Yoo. “Americans appreciate a solid brand story, not just a product, [and that] has been a really big weakness of a lot of K-beauty brands.”

Charlotte Cho, owner of K-beauty retailer Soko Glam, says it takes more than a big retailer to succeed in the American market. A brand needs a partner to help translate its story to a new audience. “Korean brands really need a partner that believes in their brand and that will handhold and market their product,” says Cho. “I’ve seen it time and time again: A Korean brand will go into large retailers and will not succeed. They need exposure beyond digital and store shelves.”

That is where beauty conglomerates come in. In 2018, AHC’s parent company, CarverKorea, was acquired by Unilever. The multinational corporation that owns brands like Dove, Simple Skincare, and Vaseline helped the Seoul-based brand develop a product line specifically for the American shopper that is available at Target and Amazon. Similarly, Primera is available exclusively at Sephora, and Mediheal is partnering with Soko Glam, Walgreens, and Amazon to launch in the U.S. These trusted partners have strong knowledge of the American beauty consumer, which helps these stalwart K-beauty brands transition smoothly.

AdvertisementADVERTISEMENT

All three brands have one thing in common: science-backed skin care. “Korea is not a country that is abundant in natural resources, so manufacturing infrastructure and development in tech is something we had to go to,” says Yoo. “The competition between Korean manufacturers creates a fast pace.” This competition is fueled by Korean consumers, who demand continued innovation.

This drives Korean brands to formulate — and reformulate — constantly. For example, AHC’s star product, Essential Eye Cream For Face, is the brand’s 8th iteration of the product. The company has been changing it once a year for nearly a decade. The silver tube that launched in Target and Amazon this summer has been made specifically for the U.S. consumer, but come 2020, there will be a new version hitting shelves in South Korea.

“Our R&D center is constantly on the hunt for new ingredients and technology which help to inform new seasons. After launching a new season of Eye Cream for Face, we start the next season the month after the launch,” says Woo Jong Ok, a scientist on the AHC R&D team. “Normally if a brand launches a new product in the same category every year, that product tends to be an upgraded version of the previous one. However, when we launch a new season of ECFF, we develop a new product that reflects the latest trend of that year.”

“

“Eastern philosophy is not about treating things after they go wrong. It’s more about taking care of yourself so they don’t go wrong.”

jacklyn Lim

”

While the newest imports are all about results-driven, science-backed skin care, they remain pointedly uncomplicated. A stark contrast to the 10-step K-Beauty stereotype, Yoo notes that today’s average Korean woman is taking the Marie Kondo approach to skin care, and paring down her routine to just the essentials; some are even going through what she calls a “skin-care diet.” For them, it’s less about piling on products to fix a problem, but rather developing a lean routine to prevent issues before they happen. “The metaphor that I like to use is western versus eastern medicine. Western medicine is: If you have a symptom, you use a drug or something to treat the symptom,” says Lim. “Eastern and North Asian philosophy is not about treating things after they go wrong. It’s more about taking care of yourself so they don’t go wrong.”

With trusted partners on board, the newest K-beauty brands are more accessible, innovative, and effective than ever. The goal is clear: Attract American consumers and capture their loyalty for a lifetime, instead of entertaining them with a passing Instagram fad. “Ultimately, K-beauty has really instilled in every American consumer's mind that it’s not about the immediate effects — skin care is a long-term thing,” says Cho. ”The third phase is a commitment, it’s a lifestyle.”

At Refinery29, we’re here to help you navigate this overwhelming world of stuff. All of our market picks are independently selected and curated by the editorial team. If you buy something we link to on our site, Refinery29 may earn commission. Travel and accommodations were provided to the author by AHC for the purpose of writing this story.

AdvertisementADVERTISEMENT